After the recession of 2008, many countries recorded a record decrease in interest rates and entered into the era of ‘cheap (money)’. Some countries have decided to go a step ahead and bring negative interest rate believing that if the interest rate in a country is low, then it is the worst time to save. Therefore, the best way to spend more than people and companies is to reduce the interest rate.

This policy was first brought to Denmark. Then Japan, Switzerland and Sweden adopted it.

Now the world economy is going through the worst phase of the last few decades due to Covid-19, so the interest rate in America and Europe is zero percent.

And there are still some countries where there is less than zero interest rate such as Denmark, Switzerland and Japan.

Japan has kept its interest rate -0.1 percent and they are not even thinking of changing it for the next few years.

How do Low interest rates affect the economy?

The head of Japan’s monetary policy, Bank of Japan Governor Haruhiko Kuroda, said a few weeks ago that the interest rate would be “quite low” to protect the economy from the bad effects of the pandemic.

After taking command of the Central Bank in 2013, Kuroda announced a large program to buy bonds to deal with deflation (falling prices of goods and services). It came to be known as ‘Kurodaz Bazooka’. But when the results did not get as expected, the Central Bank took a bigger decision to reduce the interest rate to -0.1 percent.

The aim was to motivate commercial banks to use their reserves to make loans so that the economy could be put back on track by giving loans to as many people as possible and this allowed the Bank of Japan to charge commercial banks on their deposit reserves.

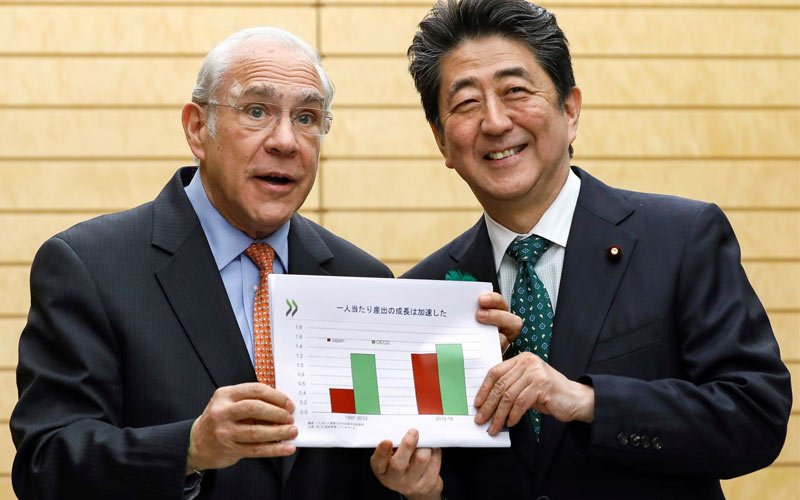

What do you mean by Shinzo Abe’s ‘Abenomics and its link with that of planning?

Kuroda’s thinking coincided with Japanese Prime Minister Shinzo Abe’s plan in 2012. This policy came to be known as ‘Abenomics’.

There were three pillars or three ‘arrows’ of ‘Abenomics’ – the increase in fiscal spending, structural reforms and long-term economic policy that would kill an economy that had been stagnating for years.

According to Matthew Godman of the Center for Strategic and International Studies, “Japan’s policy of giving easy money was of paramount importance.”

According to him, Japan could not sustain on both the other parameters.

Economists argue that Governor Kuroda made a different effort, but he also believes that even before the epidemic, banks had “failed to meet the proposed 2% inflation target.”

“It kept the economy down and under pressure of deflation in general,” says Goodman.

What was the impact on General Economic Development?

Other experts believe that the economic results have been very favourable. “In the past decade, Japan has achieved moderate economic growth,” says Takeshi Tashiro, a researcher at the Peterson Institute for International Economics.

Difficulties The rising age of working people ‘did not stop sustained recovery,’ some experts believe that key measures taken by the central bank, such as negative interest rates, the purchase of large amounts of bonds and control of the ‘yield curve’, were necessary measures. .

These did not yield the expected results, but the economic situation has improved in the last decade. Now Japan has to deal with the challenges caused by the Covid-19 pandemic in a short time.

Matthew Japan says, “Japan is struggling with deflation, debt and the growing age of the population.”

According to him, Prime Minister Yoshihida Suga has set an ambitious zero-emission target by 2050.

From the experience of Japanese monetary policy in recent years, Paul Sheard states that during periods of low rates in Japan, the government promoted fiscal consolidation and tightened fiscal policy over various periods.

An important lesson of the whole process, says Randall Kroszner, is that “he was not aggressive in the beginning to fight deflation”

“Once the expectations of deflation have receded, it can be extremely difficult for the central bank to raise expectations and raise the level of prices.” And For the time being, the country will have to continue to look for ways to increase consumption and investment in the midst of an epidemic with a shrinking young population.

Also, read our latest blog on “The New Investment Plan Between China and Iran and How it Affects the Global Economic System”, Click here.