After the Finance minister Mr. Piyush Goyal announced the 2019 Interim Budget this month, there has been speculation, some very satisfied people, some confusions, and endless discussions. While there is too much information, Indore HD has curated a quick guide which takes you through the entire budget in a jiffy. Make sure that you read till the end, we are sure you will come out more informed and with a clear insight to shine at the next Chai Pe Charcha, and obviously have livid information on the topic.

Let’s begin with addressing the elephant in the room – Why the word INTERIM?

Since the National Elections are near, the current day Government which does not have the time to present a full budget presents an Interim budget, while the task of framing the full Budget is left to the incoming government.

How is Interim Budget different from a full-fledged budget?

An Interim Budget usually doesn’t list out new schemes or doesn’t unveil any policy measures. A full-fledged Budget is presented after the House reassembles after the general election.

Who’d benefit and how?

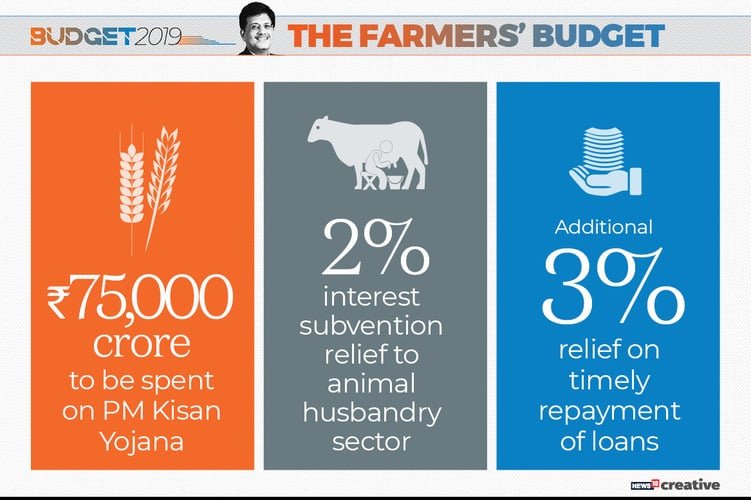

FARMERS

Since low farm incomes have been quite a concern, the government has announced a National Income Support Scheme. A 6,000 per year transfer will be made to small and marginal farmers with land upto 2 hectares. It will be interesting to see how the money will help neutralize agrarian distress!

THE MIDDLE CLASS

The major tussle relating to limited job opportunities, implementation of GST, and the perception that the government has done little for the middle class, might change with the new tax rebate, thereby helping BJP in urban centers and small towns.

UNORGANISED SECTOR

The ever neglected segment of our society, taking the maximum blow from demonetization and GST implementation will now see light of the day with a monthly pension for workers above 60.

WOMEN

The budget not only increased the funds available for schemes to protect women, the weightage was on recapping achievements over its tenure in terms of gender empowerment via schemes such as Ujjwala (free distribution of gas cylinders) and Mudra loans (credit facilities to micro and small enterprises) that have already helped women and will be taken further.

Moving on, following are the major takeaways from Mr. Goyal’s budget speech:-

- No income tax for earnings up to ₹5 lakh

- Individuals with gross income of up to ₹6.5 lakh need not pay any tax if they make investments in provident funds and prescribed equities

- Standard tax deduction for salaried persons raised from ₹40,000 to ₹50,000

- TDS threshold on interest on bank and post office deposits raised from ₹10,000 to ₹40,000

- TDS threshold on rental income increased from ₹1.8 lakh to ₹2.4 lakh

- I-T processing of returns to be done in 24 hours

- Within the next 2 years, all verification of tax returns to be done electronically without any interface with the taxpayer

- Package of ₹6000 per annum for farmers with less than 2 hectares of land. Scheme to be called Pradhan Mantri Kisan Samman Nidhi.

- Vande Bharat Express, an indigenously developed semi high-speed train, to be launched

- One lakh digital villages planned in the next five years

- Fund allocation for the Northeast region increased to ₹ 58,166 crore, a 21% rise over last year for infrastructure development

- Anti-camcord regulations to be introduced in the Indian Cinematograph Act to prevent piracy and contact theft of Bollywood films.

- Single window clearance for Indian filmmakers.

- 25 per cent of sourcing for government projects will be from the MSMEs, of which three per cent will be from women entrepreneurs.

- National Artificial Intelligence portal to be developed soon

- ESI cover limit increased to ₹ 21,000. Minimum pension also increased to ₹ 1000.

- Mega pension scheme for workers in the organised sector with an income of less than ₹15,000. They will be able to earn ₹ 3000 after the age of 60. The scheme will be called Pradhan Mantri Shramyogi Maan Dhan Yojana.

- 2% interest subvention for farmers pursuing animal husbandry.

- All farmers affected by severe natural calamities to get 2% interest subvention and additional 3% interest subvention upon timely repayment

- Decision taken to increase MSP (minimum support price) by 1.5 times the production cost for all 22 crops

- The 22nd AIIMS to come up in Haryana

Not very surprisingly, the budget has been anti-elitist, where Aam Aadmi has been put to a lot of consideration esp. the middle-class tax payers and farmers. Overall, it appears to be a well-balanced budget, with a mix of populist and realistic statements. The most critical aspect to this was that the fiscal deficit targets be maintained even after doling out benefits. The real estate sector has been given an impetus by extending the tax holiday for affordable housing- extending the exemption period for taxing notional rent on unsold inventory from one year to two years rollover capital gains benefit for two houses, among others. This will go a long way in meeting the government’s aim of ‘Housing for All by 2022’.

HD View – The budget is quite citizen friendly, owing to its Aam Admi leaning. With Income tax limit raised, farmers woes noticed, and the economic criterion devised to address the deprived is sure to win several hearts. For the first time since independence we understand the difference between words and action (surgical strike), the realization of bridging the gap between sermon and practice. Namo will be remembered and loved by billions of Indians including those in opposition.

Let’s see how this Populist Budget is received and put into action. Meanwhile, you can drop comments below as to what is likely to change in the coming months, is the New age India changing, and what are your reviews on the NAMO journey since demonization, to the heart winning Interim budget. Is the “Aam Aadmi” satisfied? We would love to hear your opinion!

You can have a detailed view at the Ministry of Finance press release here (hyperlink) http://pib.nic.in/newsite/PrintRelease.aspx?relid=187934

Cover Image Source