UPI or Unified Payments Interface is an instant real-time payment system that gained momentum recently. It helps transfer funds instantly between the two user bank accounts through a mobile platform. UPI is a concept that allows multiple bank accounts to get into a single mobile application. The idea was developed by the ‘National Payments Corporation of India’ and RBI and IBA (Indian Bank Association) regulates it.

UPI is therefore a simple, real-time and secure mode of transferring money, that surpassed mobile wallets in terms of volume of transactions and value in 2019, March.

Why is UPI suddenly so popular?

Owing to the safe, simple, and cost effective nature of UPI, and the fact that it is a quick pay mobile-based payment system, has made it increasingly popular. Paytm, PhonePe, MobiKwik and GooglePay, and almost 144 banks offer payments via UPI, which is far greater than mobile wallet payments in terms of volume of transactions as well as value.

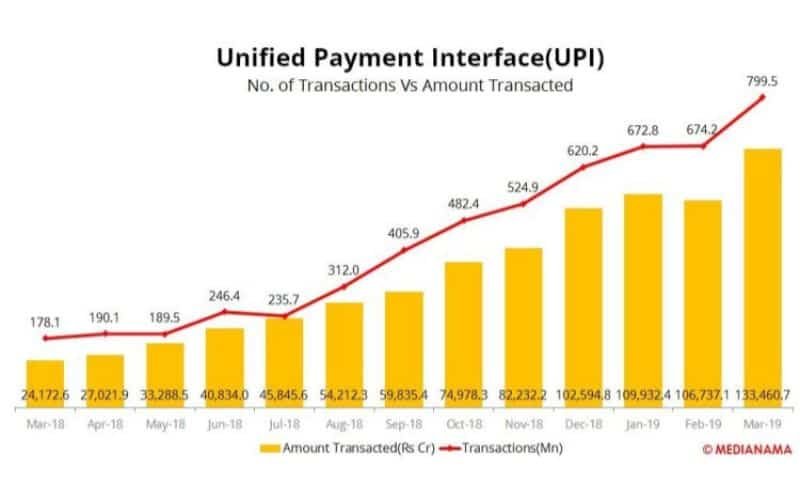

According to the Internet, “There were 384.89 million mobile wallet transactions worth ₹15,990 crore in March, compared to 799.54 million UPI transactions worth ₹1.33 trillion during the same month. As their awareness and comfort increase, people are moving towards UPI to carry out high-value transactions”.

Key Features of UPI

- Instant fund transfer through Immediate Payment Service (IMPS) which is faster than NEFT.

- Can be used to send money 24*7 owing to its digital nature.

- Needs a single mobile application for accessing various bank accounts.

- Uses Virtual Payment Address which is a unique ID as given by the bank and hence is completely safe.

- Uses Account Number with IFS Code and Mobile Number with MMID

- MPIN or Mobile Banking Personal Identification number is required to confirm each payment.

- Every bank provides its own UPI for different platforms of Android, Windows, and IOS. The banks may or may not charge for the UPI service.

- Bill Sharing facility.

- Best for doing merchant payment, utility bill payments, in-app payments, OTC payments, Barcode based payments.

- One can file a complaint from Mobile App directly

What makes UPI a secure platform?

The interface is based on a 2 Factor Authentication process followed by a quick single click payment. This feature of UPI is aligned with the regulatory guidelines that make it the safest. UPI’s 2 Factor Authentication is quite similar to an OTP, the only difference being that a MPIN is used instead of an OTP.

NPCI’s IMPS network already manages more than Rs.8k Cr. transactions per day, which will now increase with the use of more mobile phones.

The transaction happens in highly encrypted format, which makes it super safe.

Does it have any advantages over popular counterparts?

The best thing about transacting using UPIs is the fact that it does’t reveal the beneficiary’s bank account, as you transfer money across multiple bank accounts in real time. One can immediately transfer money just with the help of a phone and a unique UPI id assigned to you, without the actual hassle of standing in a bank queue. To one’s relief, no Sundays or non-working bank days or its working hours hinder the transfer process.

The idea of the UPI was developed by the ‘National Payments Corporation of India’ and RBI and IBA (Indian Bank Association) regulates it.

Most modes of bank-dependent digital payments are limited by the time of day and holidays, however all you need for a UPI is an internet connection, a sim registered to the bank, a UPI ID, and voila!

You can funds with a cumulative value of ₹2 lakh a day or 10 transactions worth that amount, whatever is easy. UPI is raging by the day and is an accepted payment mode by most e-commerce sites, popular cab provider companies, and food ordering apps.

What’s the growth graph like?

In April, 781.79 million transactions worth ₹1.42 trillion were made through UPI. It went live on August 2016, and since there there has been a significant rise from the 93,000 transactions that happened through the initial period of its launch.

How can UPI maintain its current pace?

UPI transactions have surged over four times in this last one year, but considering its ample advantages, it has far greater potential. Restrictive to the use of Internet, urban India has been enjoying its benefits while the larger popular still stays unaware majorly because of innate fears of getting robbed online. While Digital India has been a national agenda for some time now, internet penetration has to expand and needs to reach the core of the mobile using rural India as well.

UPI has been a driver of digital payments, which also comprise payments through debit and credit cards, e-wallets and e-payments.

Is the banking regulator giving UPI and e-payments a push?

The banking regulator IBA (Indian Bank Association) has announced that it will work on enabling safe, accessible, and secure payment systems within the years 2019-2021, with the idea of a less-cash society enabling a wholesome Digital India, and by providing more payment options to people even in the rural areas, who are majorly unaware of these systems. According to reports, the digital transactions are expected to grow more than quadruple from 20.69 billion in December 2018 to 87.07 billion in December 2021.