Money management may seem complicated, but it doesn’t need to be. Here, Vogue pens down an easy-to-follow, three-point guide to making every paycheque count.

“It’s that time of the month” can hold varied connotations in a woman’s life, depending on whether she is wrestling with Mother Nature or with the reality of her bank balance till the next paycheque comes through. It’s 2019, and money and menstruation are both talked about in the same hushed tones, as one stumbles along with some help from friends and family. Money matters shouldn’t be an uncomfortable conversation, but rather something that’s taught in school. Considering that’s not the norm yet, it’s no surprise that most of us get confused while navigating our financial lives.

But there are a few simple things you can do to become good with money, whether you’re just starting out or have been managing your own finances for a while. Scroll ahead for our top tips.

If you are just Starting Out

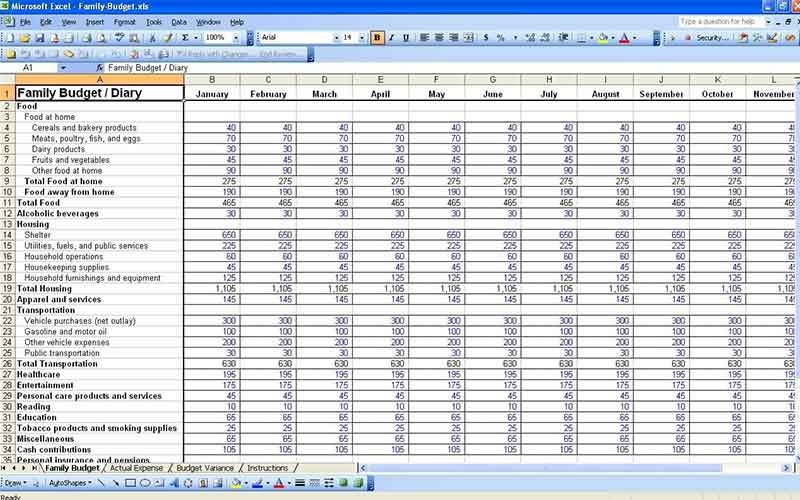

When starting off on the journey to better finances, the first step is to take a good look at where you are spending your money (and come to terms with the fact that you are the one robbing yourself blind every month, much like this writer). The best way to track your spending is to have an excel sheet where you note down every single expense you make in a month. This should include the money you took out from the ATM, the Uber you had to take on surge pricing, and the happy hour drinks that turned into non-happy hour LIITs, along with your essential costs like rent, groceries, monthly subscriptions, etc.

Making a note of every little to big expense will help you understand how much you are spending on necessities, and where there’s room to trim, even if it is a few hundreds every month (you can use these to treat your self later). Doing this for about two or three months will also make it easier for you to spot any spending patterns that you may not have realized earlier.

What to do Next?

Once you know the details of your monthly expenditure, set a fixed goal for yourself regarding how much money you will mandatorily save from each paycheque. It could be as little as Rs 1,000 a month, but make sure you don’t dip into this reserve unless it’s an emergency.

The best way to keep this money aside would be in a separate bank account, so you don’t have direct access to the amount you’re squirreling away (‘out of sight, out of mind’ doesn’t only work for the exes you’re trying to not think about). Alternatively, you could also start investing the extra funds, depending on the goals you have, which your bank can help you identify. Do this at the beginning of every month so that the rest of your expenses can organically adjust to the money left, instead of you struggling to put aside money at the end of the month. Doing this for just three to six months could allow you to buy that watch you’ve been eyeing, or go on a luxurious vacation that you thought you didn’t have money for.

The Big Leap

This last tip is for when you cross the first two stages and become an expert in saving money—which can take a different amount of time for everyone. You’re ready to get yourself a credit card. While many films have told us that splurging with credit cards can lead to a person ending up with thousands in debt, there is definitely a smart way to use your credit card to actually save money in the long run. Start out small, by paying your phone bills and taking care of your other monthly necessities.

Every time you swipe the card, you gain points, which can get you anywhere from free movie tickets and shopping cards to free flights. Every card offers different goodies that you can choose from, depending on your lifestyle. The only thing to remember is that you have to pay the card in full every month. This works best when you know your approximate monthly budget and can cover all the expenses with your salary, without having to wait for the next cheque to pay off your card.

We’ve got you some more tips to keep you Bank Balance up and right. Read here to know more